Dr. Bijna Kotak Dasani MBE FRSA

For many, being able to have access to a transaction account can be that vital first step toward broader financial inclusion as it allows people to store money, and send and receive payments. The latest figures from The Global Findex Database 2021 show that although 71% of people in developing countries have a financial account, over 1.4 billion people worldwide still remain unbanked. These people tend to be women, economically disadvantaged, less educated, living in rural areas and are typically hardest to reach.

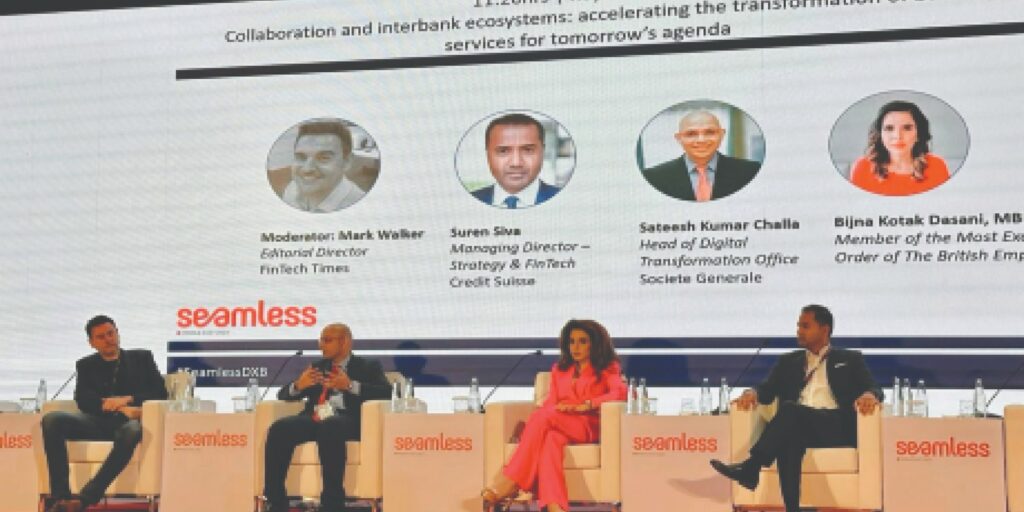

‘They’re not underbanked, they’re simply unbanked,” explained Dr. Bijna Kotak Dasani, Member of the Most Excellent Order of The British Empire and former investment banker turned Venture Capitalist, to Seamless Xtra at the Seamless Middle East show in Dubai recently.

“The evidential gap, and corresponding opportunity are clear. The financial services ecosystem cannot be inclusive until all eight billion people on the planet have access to a bank account (at a point in time, subject to age, etc of course). Today, one billion people don’t have a digital identity. So without a digital identity and without a bank account, you cannot be included. Therefore, the fundamentals of inclusion need to start there.”

As a member of several Senior Executive Management Committees Dr. Bijna has spent a chunk of her career managing assets under management (AUM) exceeding tens of billions (GBP) whilst leading various operations on behalf of some of the world’s most prestigious institutions within the financial services sector including Goldman Sachs, Deutsche Bank, SSgA and Morgan Stanley. She currently advises and serves the Boards of a range of companies globally.

Despite her concerns about those that remain marginalised in today’s society she believes a roadmap to further progress and increased inclusivity does already exist, and can be accelerated through Fintech and surrounding propositions.

Dr. Bijna took part in a keynote panel at the Seamless Middle East show in Dubai last month.

Banking the unbanked

“We have a challenge, yet we also have an example of a solution, and I think if we scale that globally in a strategic way, we’ll get to a better outcome faster,” she remarks. The example Dr. Bijna is referring to is the Unified Payments Interface (UPI) system, a payment platform built by National Payments Corporation of India (NPCI) that allows instant online payments between the bank accounts of any two parties. It was launched in India in 2016 following observations of places like Europe and the way in which open banking systems were being implemented.

“I lived in India through the pandemic and the UPI system was launched in 2016 for public use. The Unified Payments Interface (UPI) is an instant payment system developed by National Payments Corporation of India (NPCI). The interface facilitates inter-bank peer-to-peer (P2P) and person-to merchant (P2M) transactions.

“India observed the learnings from GDPR, PSD II and open-banking very closely in the West. They took the learnings from trial-and-error and solidified their proposition where data to an extent is anonymised and consumers’ banking system is protected. Furthermore, UPI is regulated by India’s Central Bank, RBI.”

UPI is a vehicle for (almost) instant transfer of monies between bank accounts via one single application, which acts as an intermediary portal. This means consumers can send and receive money, pay bills and authorize payments on one interface in a single step, thereby simplifying the whole online transaction process.

PhonePe currently tops the list of UPI service providers accounting for 50 percent of transactions processed in India, as of December 2022. Most of these transactions were for daily usage items such as groceries and supermarkets, mobile recharges and fast food restaurants, which have low ticket sizes and high repeat value. The company recently received further investment – $100 million USD from General Atlantic – further to $850 million USD that was raised last year.

PhonePe is reportedly looking to deploy the funds to strengthen its data management and leverage this to create new financial services offerings at scale across India. “That is significant,” Dr.Bijna says. “It also signals that there is a strong appetite for this kind of provision because it adds depth and value across the ecosystem. Considering the unbanked population, we can create digital identities, educate with financial services literacy and integrate them into the UPI network – this is effectively a process of financial inclusion’’.

“Again, in India, the government has taken a very clear measure to give people digital identities to the Aadhaar plan. Last year, in the financial year to 2022, 7.2 billion UPI transactions took place on UPI. That’s 50% of all transactions in India, a country of 1.4 billion people, of which the majority are the emerging middle class or the lower socioeconomic segment. And they’ve iterated through trial-and error so there’s no reason why countries in the rest of the world cannot choose to follow suit, be a fast follower and see that kind of opportunity.”

Dr. Bijna entered the fintech world about a decade ago through her work in banking and during that period she has lived and worked in the U.S, the UK, around Europe, and also in Asia. In the same time she has seen how that competitive play between banks and fintechs has shifted for the better; towards a partnership based approach whereby contribution of complementing systems is now valued.

“It’s no longer me versus you or you versus us. We understand that we’re all going to take a bigger slice of a bigger pie, and we need each other to be successful. For example, the fintechs need the platform of the banks and the regularity driven environments to know what the real world experience looks like for their propositions’.

“Equally, the banks are challenged. They have the legacy issues of regulatory implications, technology and infrastructure that need to be unraveled. So it becomes easier for them to plug and play fintechs. It’s the same for consumers. You can be targeting different segments, but if you bring the propositions on the end to end together, you’re actually generating net new revenue through existing clients using our proposition, but also net new revenue with new clients.”

Economic empowerment of women

One issue that Dr. Bijna is very much plugged into is the economic empowerment of women. She is keen to point out that data, which references an increase in household spending by women and the impact that can have, needs to be looked at in a multi-faceted way.

“In the U.S. for example, it was recently reported that women in half of marriages now bring home more than their male counterparts. That’s very interesting because that’s the first time in history and therefore you can correlate that to women spending more and perhaps earning more.

“However, in the UK it’s actually the opposite. Women typically have a third of what men have in pensions, women typically earn a third of what men do as an average salary. And although they may be responsible for handling the money, they often don’t have access to disposable money or making decisions for their children or for themselves. Although the UK on the outside is regarded as a developed economy, it is going through an economic crisis and when you combine that with social, cultural and socioeconomic layers you find that if you are a woman and if you’re an ethnic minority, you are more likely to be from – or be subjected to – a lower socioeconomic class.”

One of the examples Dr.Bijna gives is of a husband and wife who own a house, which is a joint asset. If things go wrong with the marriage and one half decides not to pay anything towards that mortgage, it can have devastating consequences where the other half is burdened with the full liability whereby they could face a repossession or a foreclosure. Although to help address this and other similar situations, economic abuse recently became a criminal offense in the UK, in April 2023, introduced as part of section 76 of the Serious Crime Act 2015.

“We also have banks like Monzo, Barclays, Lloyds signed up to different work around economic abuse, which is the exact opposite of empowering women. But to empower them, you need to understand what’s paralyzing them and then work through it,” says Dr. Bijna.

“So now banks are consciously stepping up and saying we can’t let that happen. We have to work with all types of people that are vulnerable customers for varying reasons and we have to make sure there are parameters in place to stop somebody ending up in debt or other extreme circumstances such as repossession or foreclosure. We have a responsibility to getting our debt repaid, but also not paralyze them further with charges for debt administration”.

Whilst progress has been made and there is cause for optimism, Dr. Bijna is still well aware of the road ahead to a more inclusive society, and a society that empowers women and the vulnerable, both financially and socially. “I’ve seen progress, whether it’s enough, depends on the maturity of the country. And it depends on the social and economic status of that country and also the political regime. The World Economic Forum recently reported that women are still over 110 years away from pay parity. We can always do more, but I think we are raising awareness. The fact that we’re having this conversation here today. I think that is all positive progress and we need to continue to stay on the accelerator.”

Presently, in her philanthropic capacity, Dr. Bijna is an appointed member of the United Nations (UN) Women UK delegation; where she is engaged with the Commission on the Status of Women (CSW), the principal global intergovernmental body exclusively dedicated to the promotion of gender equality and the empowerment of women. She is also an ambassador for Surviving Economic Abuse, a registered UK charity and has contributed to UK-wide legislative changes for policies in this domain. For more information, please visit www.bijna.com